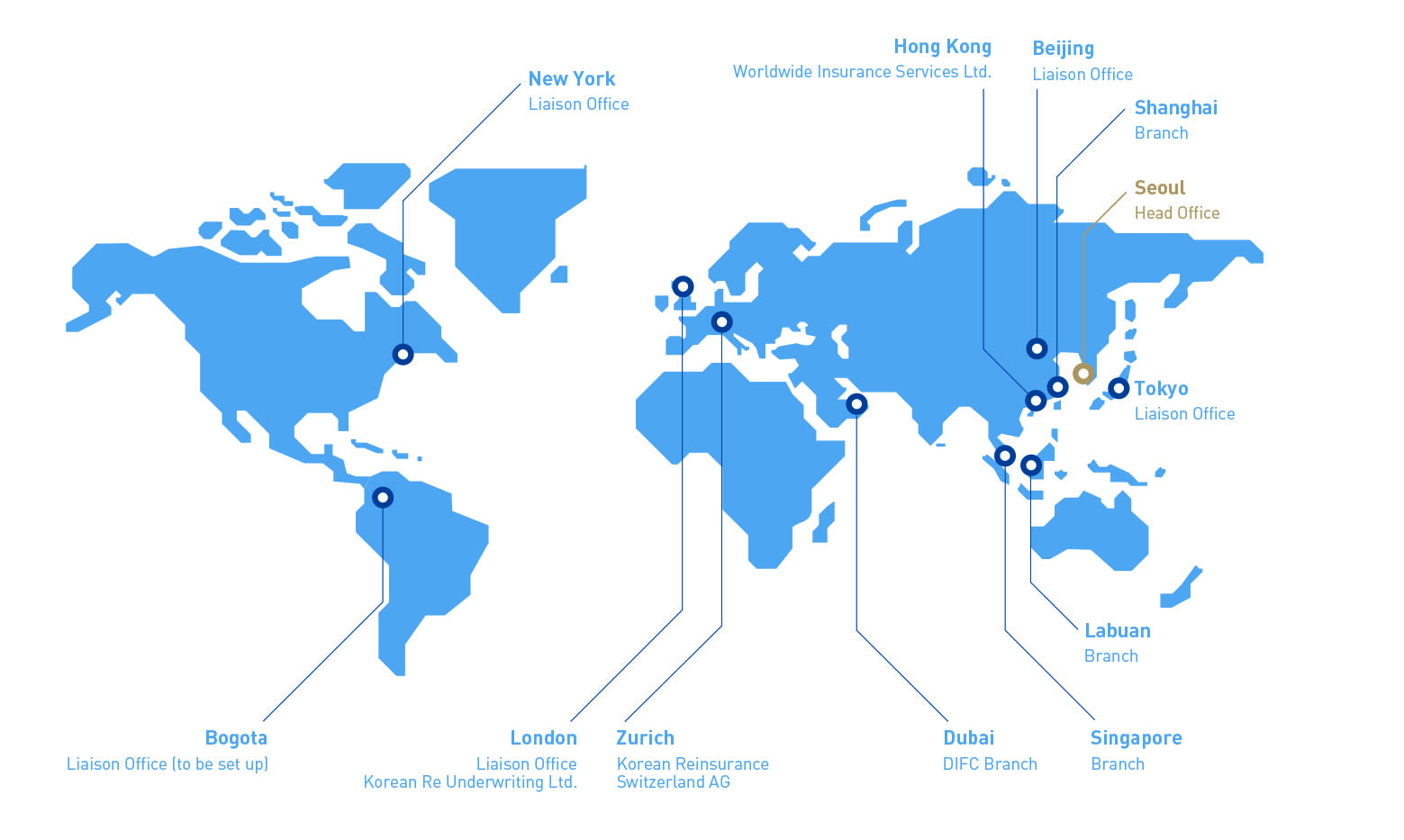

We are continuously expanding our global presence in strategically important locations, while also making them more competitive.

In 2015, we successfully became a member of Lloyd’s of London, the birthplace of insurance undertakings, through a special purpose syndicate, Korean Re Underwriting Ltd.

The hard work of the Global Project Team—a dedicated group created in 2017 tasked with the mission of expanding our global network—paid off almost immediately. Our Labuan branch was established in Malaysia that same year, and a year later our Dubai liaison office in the UAE was successfully converted into a branch, broadening our network and presence worldwide.

Under the goal of raising our overseas business portion up to 80% in line with our “Vision 2050,” which we set in 2014, we have now spent more than five years strengthening our global competitiveness and extending our reach across the world.

EXPANDING OUR GLOBAL PRESENCE

In 2019, we made a firm commitment to broaden our overseas networks. We have established strongholds in Europe and China, both of which are important reinsurance markets, and also secured an entry point to access the South American and Central American markets, an area of huge growth potential.

KRSA Awarded with an “A” Rating from S&P

Our subsidiary Korean Re Switzerland AG (KRSA) was established in June 2019 in Zurich, Switzerland, and has already obtained an “A” credit rating from Standard & Poor’s (S&P), one of the top credit rating agencies in the world.

S&P forecast that KRSA can run a stable business in Europe on the back of excellent operational resources and risk management capabilities of the parent company, and is expected to play a pivotal role in expanding Korean Re’s business overseas.

An “A” credit rating allows for easier and greater access to profitable accounts. KRSA is more likely to bring us closer to profitable accounts in advanced markets, and has the strong potential to grow into a key hub among all of Korean Re’s affiliates worldwide.

Shanghai Branch Approved

We learned from Chinese financial supervisory authorities on December 30, 2019 that Korean Re was finally authorized to establish a branch office in Shanghai. That marked our second office in Mainland China after the Beijing office was opened in 1997.

While the Beijing Office has carried out market research and support functions for our head office, the Shanghai Office is tasked with leading business activities across China.

China represents the largest insurance market in Asia, and the second largest in the world. In 2018, this vast market grew 3.92% from a year earlier, generating USD 570 billion in gross written premiums that accounted for 11.6% of the world’s total production. Thus, it has enormous growth potential for us.

GLOBAL NETWORK

Bogota Office in Colombia Coming Soon

We are going to see the opening of a liaison office in Bogota, the capital of Colombia, in the first half of 2020. When all preparatory work is completed, we will jump-start efforts to explore new opportunities across Latin America and the Caribbean from the second half of the year.

Compared to other continents, South America has a lower insurance penetration rate. According to Swiss Re Sigma 2018, the penetration rate for non-life and life insurance stood at 1.91% and 0.88%, respectively. Thus, there is a great deal of room to expand in this untapped market.

Setting up a new operation in this region aims at broadening our business coverage and adding geographical diversity to our portfolio. This bold move is expected to contribute to our profitability and help us expand from an Asia-centric portfolio.